Apex Radar - Week 52

December 23 - December 27 2024

Weekly check of the market

Magnificent 7, Nasdaq and S&P500

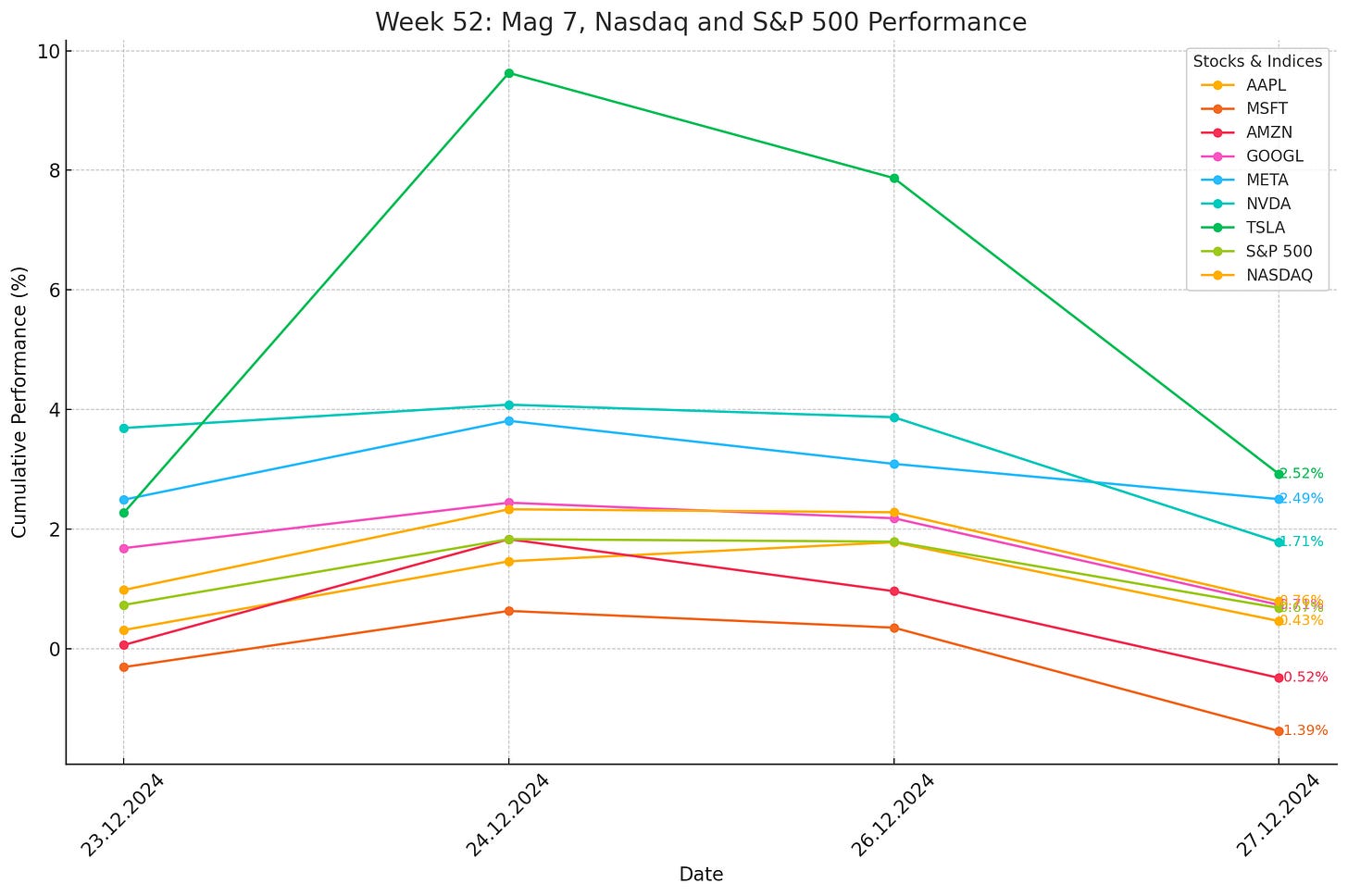

In Week 52, the Nasdaq and S&P 500 posted gains of 0.76% and 0.67%, respectively, during the light-volume, holiday-shortened week, signaling the arrival of the long-anticipated "Santa Claus Rally." Even Friday's sudden selloff, coinciding with South Korea's impeachment of its acting president, appears to have had little impact on the broader market narrative.The drop was likely due to investors cashing in profits and adjusting their portfolios for the year-end, moving money from stocks to bonds. Experts note that the excitement in the market has cooled, with a more cautious outlook now in place. However, things like political instability or changes in Fed policies could still cause sudden market swings.

In contrast to the previous week, where Tesla and Meta were among the biggest laggards, both emerged as top performers this week. Tesla gained 2.52%, while Meta rose 2.49% on a weekly basis. Uncertainty surrounding a potential TikTok ban continues to generate short-term momentum for Meta’s stock. Meanwhile, Tesla is striving to break its previous delivery record. Analysts anticipate a new quarterly high for vehicle deliveries; however, it remains uncertain whether this will be sufficient to achieve year-over-year unit delivery growth.

Apple made significant strides this week, nearing the unprecedented milestone of a $4 trillion market capitalization, fueled by the broader Santa rally. The stock closed the week 0.43% higher, buoyed by key announcements, including its decision not to pursue the development of its own search engine. Instead, Apple reaffirmed its strategic partnership with Google, defending the tech giant in ongoing antitrust trials over revenue-sharing agreements that designate Google as the default search engine on Safari. This stance underscores Apple’s focus on prioritizing cost-efficiency and avoiding conflicts with its privacy-centric ecosystem.

Meanwhile, Google also ended the week on a positive note, gaining 0.71%. The company continues to face scrutiny over its dominance in online search but maintains investor confidence through its robust AI advancements and partnerships like the one with Apple.

Amazon declined for the second consecutive week, falling 0.52%, amid reports highlighting serious injuries among its UK workforce, including bone fractures and instances of unconsciousness. Unions have attributed these incidents to the intense pace at Amazon’s facilities, especially those using robotics. In response, Amazon asserts that its injury rates remain well below industry averages and underscores its ongoing investments in safety enhancements.

Like Amazon, Microsoft also saw its stock decline for the second consecutive week, this time leading losses among the "Magnificent 7" companies. It was one of only two to end the week in negative territory, down 1.39%, despite the Nasdaq and S&P 500 posting gains. Microsoft recently integrated its AI assistant, Copilot, into its Microsoft 365 consumer subscription service in Australia and Southeast Asia. However, the move has faced criticism, as it includes a mandatory price increase for all users, with no option to opt out for those who do not wish to use the AI assistant.

Euphoria around Bitcoin appears to be fading, with the cryptocurrency trading below the $100K mark throughout the week. Despite attempts to breach $100K amid the broader Santa rally in equities, Friday’s market selloff pushed Bitcoin further away from the milestone. It is now consolidating within the $93,000-$94,000 range, reflecting a 1.2% decline on a weekly basis.

Fear & Greed Index

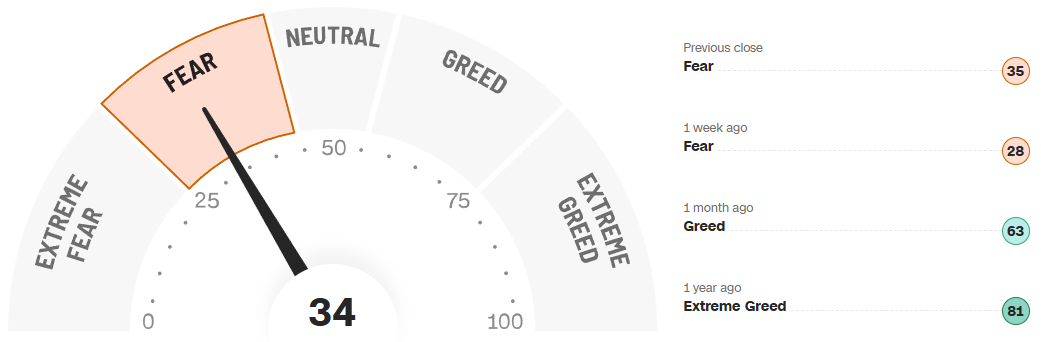

Although the Fear & Greed Index rose from 28 to 34, market sentiment remains cautious as we close the year. Investors are adopting a cautious stance, with 2025 expected to be shaped by transformative AI advancements and significant political shifts, which could drive both sector-specific and macro trends.

CBOE Volatility Index (VIX)

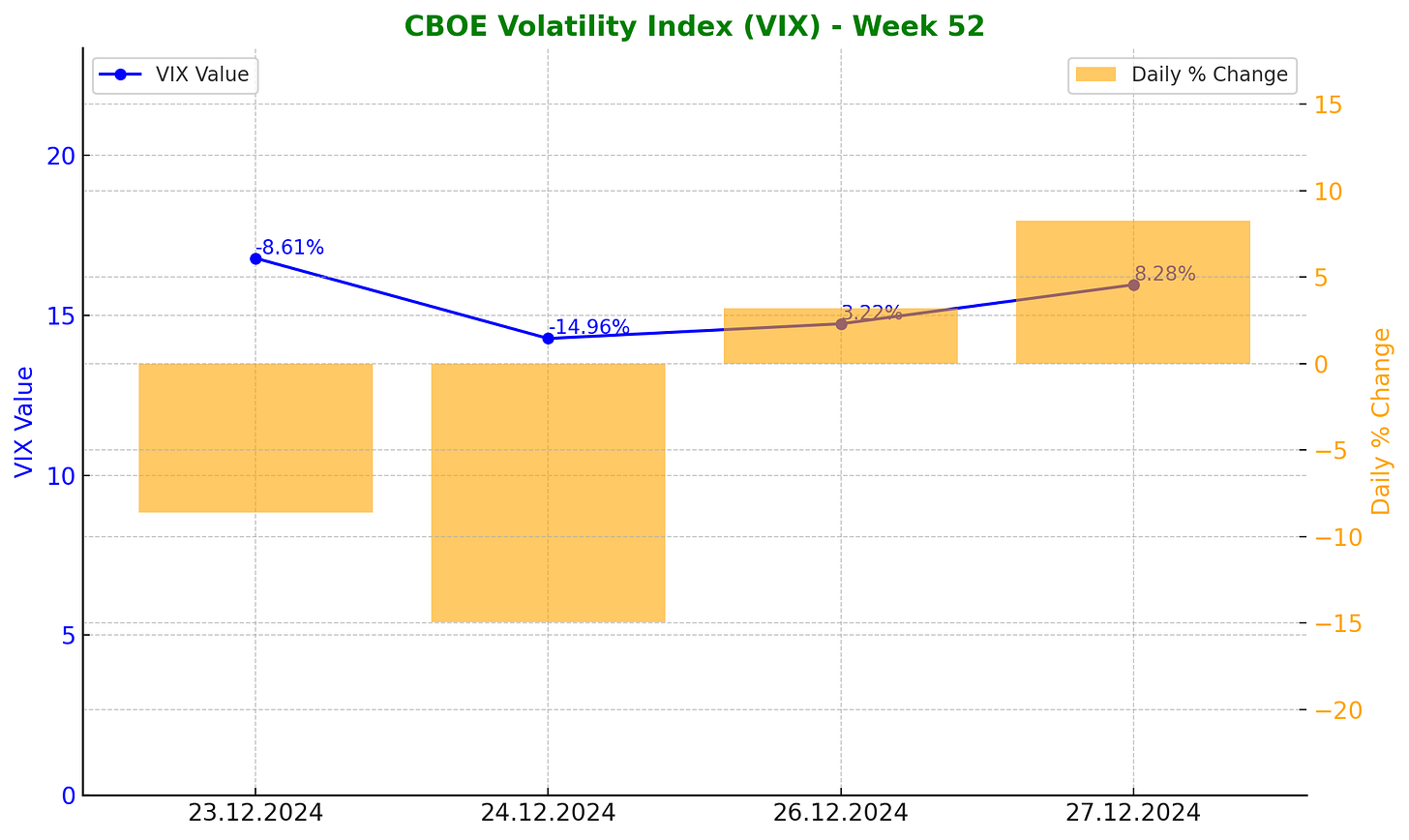

The VIX dropped 13.13% in Week 52, driven by a modest Santa rally, as expected. However, Friday brought a spike in volatility, likely influenced by political tensions, such as South Korea's impeachment of its acting president, and year-end profit-taking and portfolio rebalancing by large institutional investors.

News of the week

The US proposes rules to make healthcare data more secure

AI Needs So Much Power, It’s Making Yours Worse

Amazon Wants Merchants to Sell Everywhere—Except Temu

OpenAI Has Discussed Making a Humanoid Robot

Microsoft and OpenAI Wrangle Over Terms of Their Blockbuster Partnership

Quantum Computing Is Finally Here. But What Is It?

The Stakes in Amazon’s Union Battle With Delivery Drivers

Masayoshi Son’s Quest to Become the Next Nvidia

Meta is reportedly adding displays to its Ray-Ban smart glasses

Microsoft Is Forcing Its AI Assistant on People—and Making Them Pay

Trump asks Supreme Court to pause TikTok ban

OpenAI Wows the Crowd as New Scaling Law Passes Its First Test

Nvidia, OpenAI and Their Rivals Expand AI Turf Wars

OpenAI announces plan to transform into a for-profit company

Don’t Look Now, but China’s AI Is Catching Up Fast

Tesla Record Deliveries Expected. This Is Why It Probably Doesn't Matter For TSLA.

Nvidia bets on robotics to drive future growth

OpenAI Has Edge Over Google in Winning Publishers’ Business

How Apple Developed an Nvidia Allergy

Meta Expects AI Characters to Generate and Share Social Media Content

Microsoft and OpenAI’s Secret AGI Definition

Microsoft and OpenAI Set $100 Billion Target For Achieving ‘AGI'

Chinese Data Center Operator Yovole Is Said to Consider US IPO

Lithium Suppliers Seek to Rein in Price Discounts in 2025 Talks

Google CEO says AI model Gemini will be the company’s ‘biggest focus’ in 2025

US Investors Pay Biggest Premium for TSMC Shares in Two Months

OpenAI Announces Plan to Become Delaware Public Benefit Corporation

ChatGPT access has recovered after an outage Thursday afternoon

Even Apple wasn’t able to make VR headsets mainstream in 2024

Google CEO Pichai tells employees to gear up for big 2025: ‘The stakes are high’

Google to court: we’ll change our Apple deal, but please let us keep Chrome

X raises Premium Plus subscription pricing by almost 40 percent

Nvidia GeForce RTX 5060 And 5060 Ti: Leaks, Rumours, And Our Thoughts

Eddy Cue explains why Apple won’t make a search engine

Blue Origin Conducts Key Rocket Test Ahead of Launch

Musk Gains Another Ally in Effort to Block OpenAI For-Profit Conversion

Apple seeks to defend Google's billion-dollar payments in search case

Uber Disappointed as Taiwan Rejects Deal for Delivery Hero Unit

Alibaba, E-Mart to Create $4 Billion E-Commerce JV in Korea

Nio’s Mass Market Push Draws Scorn as EV Maker Promises a Profit

2024 was a big year for Windows on Arm

MAGA vs. Musk: Immigration Fight Cracks Populist-Tech Bro Alliance

Meta’s ‘software update issue’ has been breaking Quest headsets for weeks

South Korean lawmakers impeach acting president Han Duck-soo

If you found this article valuable, I’d be grateful if you shared it with others who might also find it interesting. Thank you!