Apex Radar - Week 51

December 16 - December 20 2024

Weekly check of the market

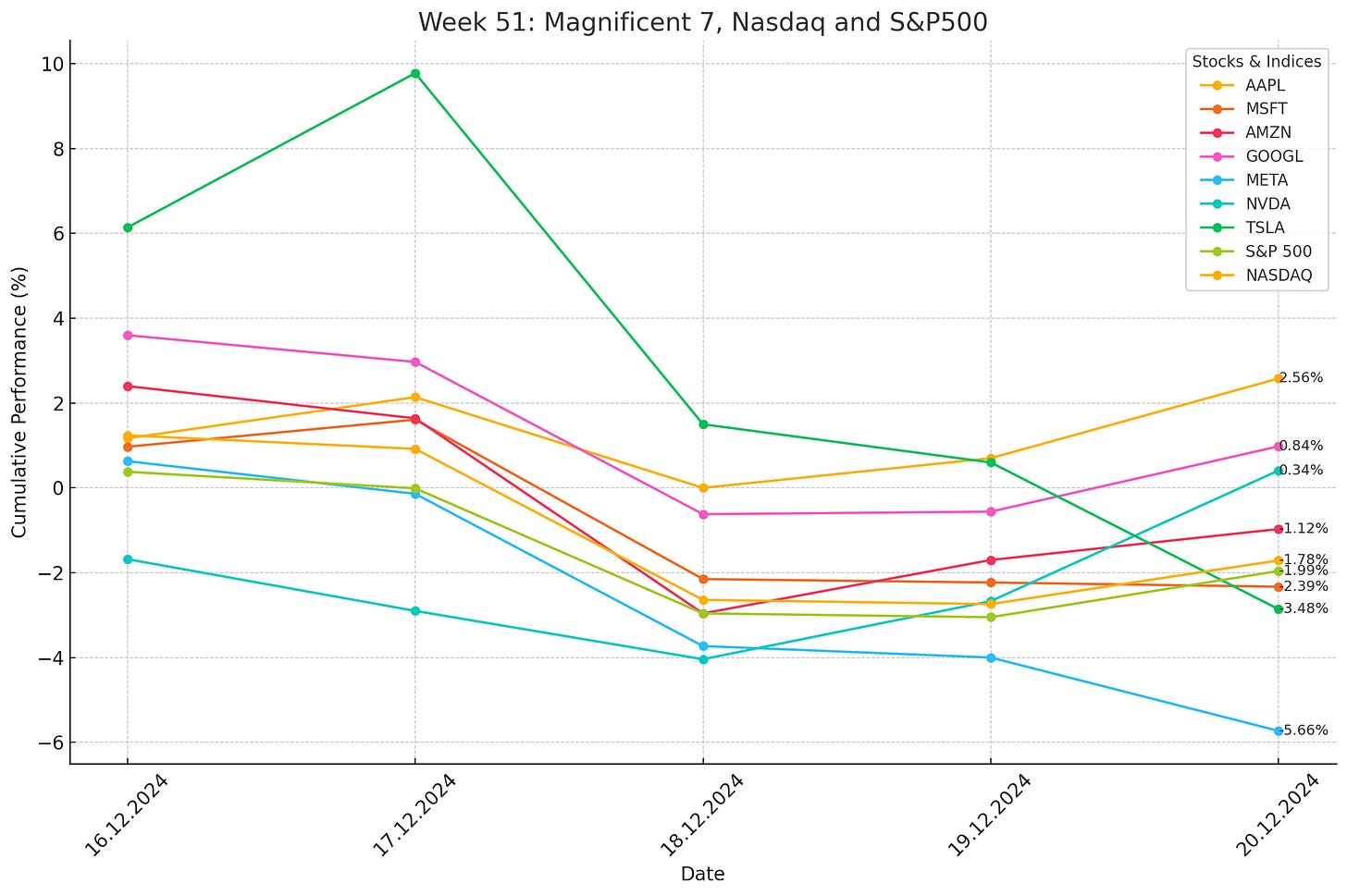

Magnificent 7, Nasdaq and S&P500

Nasdaq and S&P 500 posted their steepest weekly decline since mid-November, dropping around 2%. The selloff was driven by a surprisingly hawkish stance from Federal Reserve officials, who scaled back expectations for the number of rate cuts in 2025. The traditional "Santa Claus Rally," which typically sees a 1.3% gain during the final five trading days of the year and the first two in January, may not materialize this year. November’s strong performance may have absorbed some of the seasonal momentum, leaving little room for a year-end boost. Rising bond yields and elevated valuations add further headwinds. While some strategists view this pullback as a healthy reset for potential rebounds, others caution that deeper losses could undermine the market's bullish outlook. Meanwhile, expectations for a January Fed rate cut dropped sharply to 8.6% from 18.5% last week, with 2025 easing projections lowered by 11 basis points to 52 basis points.

Last week, we reported Tesla's momentum showed no signs of slowing. However, this week highlighted how quickly things can shift. After a 10% stock surge on Monday and Tuesday, Tesla dropped over 8% following the Fed meeting Wednesday. Friday’s recall of nearly 700,000 vehicles due to a TPMS issue led to an additional 3.46% decline.

Meta experienced the largest value decline among the Magnificent 7 companies this week, driven by uncertainty over a potential TikTok ban and a privacy and interoperability dispute with Apple. These challenges impacted investor sentiment, resulting in a 5.66% drop in Meta's stock over the week.

Google was among the few companies to end the week in the green, rising 0.84% from last week. Key announcements included plans to add an ‘AI Mode’ option to its search engine, a 10% reduction in managerial roles for efficiency, and a partnership between Google DeepMind and humanoid robotics maker Apptronik.

The big winner this week was Apple, closing Friday up 2.56% for the week. Despite a market slump on Wednesday that saw most Magnificent 7 stocks drop over 3%, Apple showed resilience, declining just 2%. Positive news about a new doorbell camera with Face ID and its strong stance in its dispute with Meta contributed to its outperformance.

Microsoft remained nearly flat this week, with a slight decrease of 0.10%, as it continued to solidify its AI leadership. The company made headlines for ordering 485,000 Nvidia AI chips in 2024, more than double the purchases of its nearest U.S. rivals, showcasing its aggressive investment in AI infrastructure.

Amazon declined by 1.12% this week, facing significant labor unrest as workers at its Staten Island JFK8 Fulfillment Center joined a nationwide strike. The protests, organized by the Teamsters Union, demanded higher wages, better benefits, and improved working conditions, adding pressure during the peak holiday season. There are also reports of

Bitcoin hit another all-time high this week, surpassing $108,000 on Tuesday. However, this peak was short-lived as it dropped nearly 10% the next day, with the price now hovering around $95,000. This marks an 8% weekly decline at the time of writing, highlighting volatility in the short term.

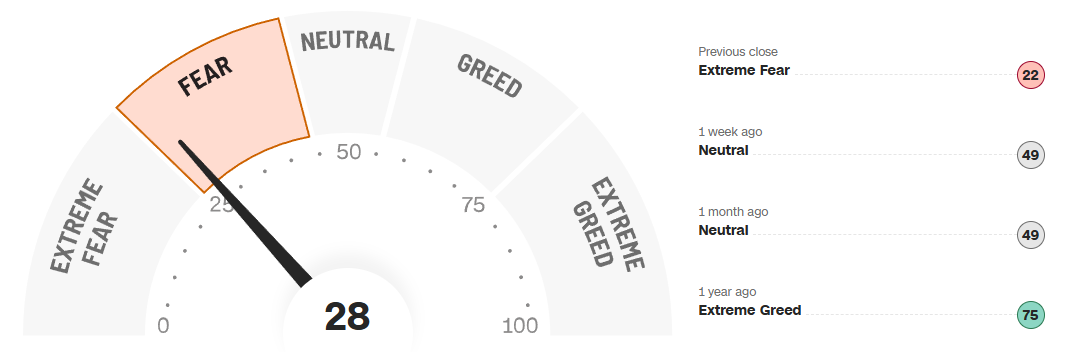

Fear & Greed Index

This week's Fed announcement also impacted the Fear & Greed Index, which tumbled to 28 from around 50, nearing the 'extreme fear' zone. It underscores how swiftly market sentiment can shift when valuations are elevated, and a correction has been absent for an extended period.

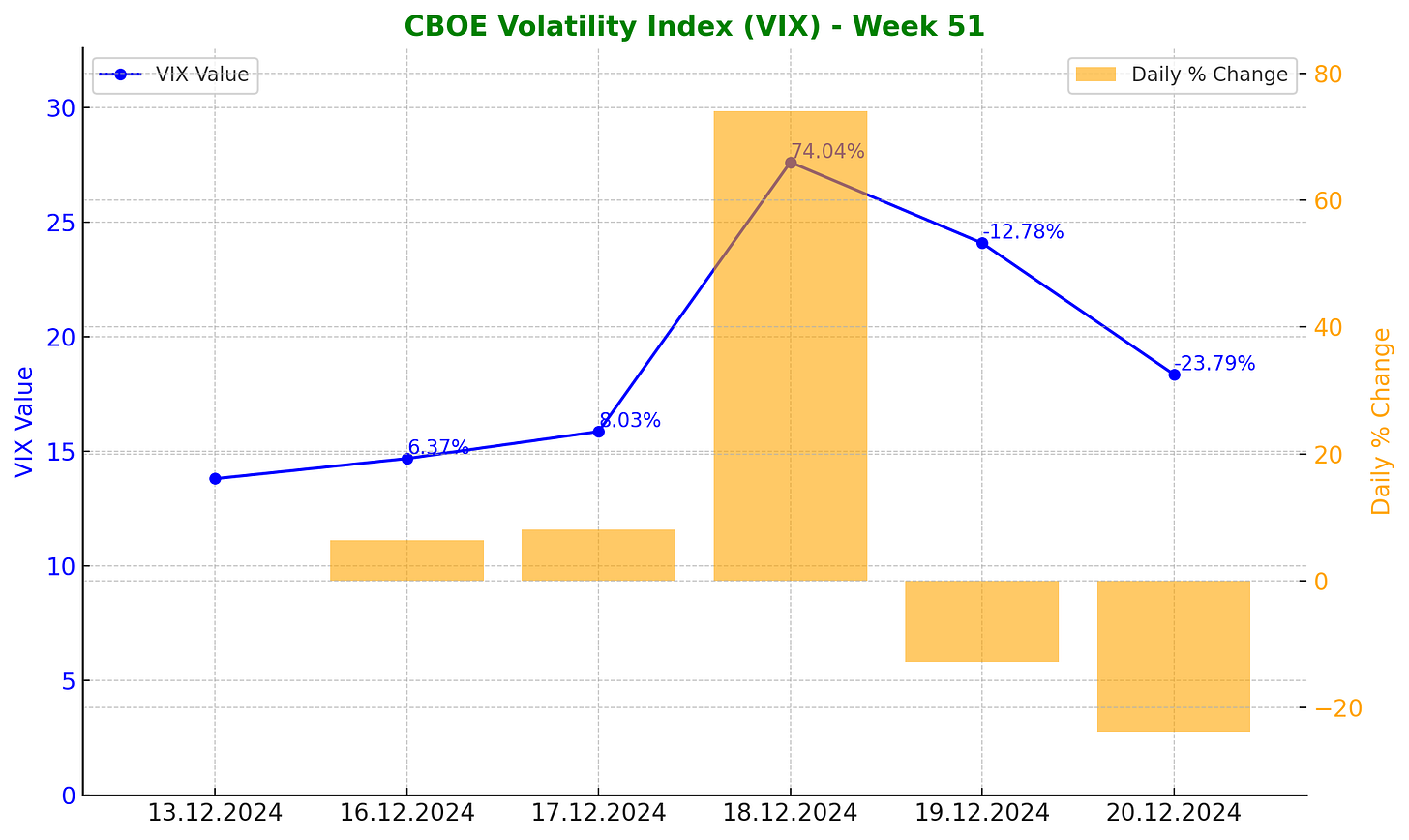

CBOE Volatility Index (VIX)

The VIX surged 32.95% in Week 51, driven by a massive 74.04% spike on Wednesday as U.S. stocks pulled back following the Fed's announcement on future rate cut plans.

Earnings of the week

Micron

Micron shares plunged 13% after issuing weak Q2 guidance, citing softness in consumer markets like PCs and automotive despite strong performance in its data center segment, which now drives over half of total sales. Q1 revenue rose 84% to $8.71B, in line with estimates, and adjusted EPS of $1.79 exceeded expectations. For Q2, Micron forecasts revenue of $7.7B–$8.1B and EPS of $1.33–$1.53, both missing analyst expectations of $8.94B revenue and $1.91 EPS. CEO Sanjay Mehrotra highlighted AI-driven opportunities and server growth while noting consumer market recovery is expected in the fiscal year’s second half.

Nike

Nike CEO Elliott Hill revealed a turnaround strategy after Q2 revenue fell 8% YoY to $12.35B, beating estimates of $12.13B, while EPS dropped to $0.78 from $1.03 YoY. Declines were driven by over-reliance on promotions and inventory challenges. Hill plans to shift Nike back to full-price sales, refocus on sport and performance, rebuild wholesale partnerships, and cut supply of oversaturated lifestyle models like Air Force 1s. Digital and store sales dropped 13%, wholesale revenue fell 3%, and China sales were down 8%. Data showed global inventory at $8B, higher than desired.

News of the week

Google CEO Sundar Pichai revealed a 10% cut in top management roles as part of a multi-year efficiency drive. Facing AI competition from OpenAI, Google aims to streamline operations, boost generative AI features, and modernize its culture to stay competitive.

Powell Says Future Cuts Would Require Fresh Inflation Progress

The Federal Reserve reduced its benchmark interest rate by 0.25%, bringing it to 4.25%-4.5%, marking the third consecutive cut this year. Chair Jerome Powell highlighted a cautious approach moving forward, tying future cuts to further progress in reducing inflation, which remains above the 2% target. Fed projections suggest only two additional rate cuts in 2025, with the rate expected to reach 3.75%-4% by year-end. Recent data shows resilient labor markets, modestly rising economic growth, and inflation slowing less than anticipated. Uncertainty looms over potential policies from the Trump administration, which could influence inflation and labor markets. The Fed also adjusted its reverse repo facility to manage money market rates and support balance sheet reductions. Markets reacted with the S&P 500 declining and Treasury yields rising.

OpenAI Unveils More Advanced Reasoning Model in Race With Google

OpenAI unveiled its next-generation reasoning models, o3 and o3-mini, for safety testing, skipping o2 due to potential trademark conflicts. These models excel in breaking tasks into smaller steps and showcasing their reasoning process. Early benchmarks are impressive, with o3 outperforming previous models by 22.8% in coding tests, nearly acing AIME 2024, and solving 25.2% of challenging math problems—far surpassing competitors. OpenAI also introduced deliberative alignment, a step-by-step safety decision process, enhancing adherence to policies compared to earlier models like GPT-4. Public release details are pending, with research community testing underway.

TikTok's Trip to Supreme Court Could Play Out in Three Main Ways

The Supreme Court will hear TikTok’s appeal against a U.S. law potentially banning the app, with oral arguments set for Jan. 10, ahead of the Jan. 19 ban deadline. Legal experts see three possible outcomes: a quick decision likely against TikTok, a temporary injunction freezing the law to allow negotiations with the incoming Trump administration, or no injunction, allowing the ban to take effect. TikTok’s general counsel remains optimistic, but uncertainty persists for creators, businesses, and the app’s future until the court rules.

Databricks secures monumental $10bn Series J, catapulting valuation to $62bn

Databricks has secured a monumental $10 billion in Series J funding, raising $8.6 billion so far and reaching a $62 billion valuation. Led by Thrive Capital with support from Andreessen Horowitz and others, the funds will fuel AI product development, international expansion, and employee liquidity. Databricks, growing 60% year-over-year, plans to leverage its Data Intelligence Platform to democratize AI and data access, driving innovation and efficiency for businesses. CEO Ali Ghodsi emphasized Databricks’ long-term vision as it approaches positive free cash flow this quarter.

Microsoft Outpaces Rivals with 485,000 Nvidia AI Chip Orders, Solidifying AI Leadership

Microsoft solidified its AI leadership in 2024 by purchasing 485,000 Nvidia Hopper AI chips, more than double the orders of its nearest U.S. rivals, Amazon (196,000) and Google (169,000). Meta followed with 224,000 chips, while Chinese firms ByteDance and Tencent ordered 230,000 each. These acquisitions underscore Microsoft's aggressive push to expand AI infrastructure and support innovations in artificial intelligence and cloud services. The move also highlights its commitment to staying ahead in AI research, reinforced by its significant investment in OpenAI. With MSFT stock up 19% YTD, Microsoft remains a top pick in the AI sector.

Google Plans to Add ‘AI Mode’ Option to Search

Google plans to add "AI Mode" to its search engine, offering conversational answers similar to its Gemini chatbot, aiming to counter rivals like ChatGPT. The feature, accessible via a new tab, integrates AI-driven responses with website links and follow-up prompts. This move expands Gemini's reach but invites Justice Department scrutiny amid antitrust concerns, as regulators may argue it leverages Google’s search dominance. ChatGPT remains far ahead, with 14 times Gemini's visitors in November 2024. Google faces pressure to innovate while ensuring AI Mode doesn’t disrupt its search ad revenue or escalate regulatory risks.

TikTok finally scores a win: the Supreme Court will hear its case

TikTok scored a win as the Supreme Court agreed to hear arguments on January 10th regarding the constitutionality of a law that could ban the app or force its sale. The Protecting Americans from Foreign Adversary Controlled Applications Act targets apps owned by companies in adversary countries, citing national security concerns over potential Chinese influence via ByteDance. While the decision to take the case is promising for TikTok, the court deferred halting the law until after arguments. The ban deadline, one day before Trump’s inauguration, leaves uncertainty about TikTok's future. ByteDance’s ability to sell the app remains a key question.

Google DeepMind Partners with Humanoid Robotics Maker Apptronik

Google DeepMind announced a partnership with Apptronik to combine its AI with Apptronik’s humanoid robots. Apptronik’s Apollo, a 5’8”, 160-pound robot designed for warehouse and automation tasks, will leverage DeepMind’s AI to enhance planning and adaptability. Apptronik, spun out of the University of Texas in 2016, is already collaborating with GXO and Mercedes-Benz on Apollo's development. Apollo was also showcased in Google’s announcement of the Gemini 2.0 AI model.

U.S. Prompts Nvidia, Supermicro Probe Into How Chips Ended Up in China

Nvidia and the U.S. Commerce Department are investigating how advanced AI chips, restricted under export controls, are being smuggled into China. Nvidia has tasked distributors like Supermicro and Dell to conduct spot checks in Southeast Asia, where smuggling is prevalent. Some smugglers have evaded detection by forging server serial numbers and disguising shipments. This illicit trade undermines U.S. export laws designed to limit Chinese access to advanced technologies with potential military applications. Supermicro has tightened client reviews and blocked uncooperative customers, while the Commerce Department continues to pressure companies to secure supply chains and enforce compliance. The smuggling highlights challenges in curbing China's tech access amid globalization.

Nvidia Says It Could Build a Cloud Business Rivaling AWS. Is That Possible?

Nvidia is positioning itself to rival Amazon Web Services (AWS) in cloud services by renting servers powered by its AI chips and offering AI software through DGX Cloud and Nvidia AI Enterprise. The company aims to generate $150 billion in long-term revenue from cloud and software, surpassing its current chip revenue. Nvidia’s advantage lies in its expertise in GPUs, enabling more efficient AI software. Early adopters include Amdocs and ServiceNow, which use Nvidia's tools for automating tasks like call center operations and coding. However, Nvidia faces challenges, such as limited business relationships, lower brand recognition in cloud software, and slower enterprise AI adoption. While it partners with cloud providers like AWS for now, Nvidia may eventually build its own data centers, signaling an intent to directly compete in the lucrative cloud market.

Meta rolls out live AI, translations, and Shazam to its smart glasses

Meta has rolled out new features to its Ray-Ban smart glasses, including live AI, live translations, and Shazam. The live AI feature allows users to interact naturally with Meta's assistant while it analyzes surroundings, such as suggesting recipes in a grocery store. Live translation supports real-time speech translation between English and Spanish, French, or Italian, with language pairs downloaded in advance. Shazam integration, available to all U.S. and Canadian users, identifies songs upon request. While Shazam is widely available, live AI and translation are limited to Early Access Program members. These updates come as tech giants like Meta and Google position AI assistants as a key driver for smart glasses, emphasizing their potential as "AI-native devices."

How Will Anthropic Navigate a Trump Presidency?

Anthropic’s strong AI performance has drawn users from OpenAI, but the Trump administration could challenge its growth. Anthropic’s ties to the effective altruism movement, emphasizing AI risks over innovation, may clash with Trump’s deregulatory AI agenda. CEO Dario Amodei’s past criticisms of Trump could add tension. Both Anthropic and OpenAI are bolstering Republican policy connections, but Anthropic’s focus is on emerging talent for policy roles. Recent moves, like partnerships with Palantir and allowing U.S. military use of its models, show Anthropic’s efforts to align with the incoming administration. Meanwhile, Anthropic avoids Elon Musk’s scrutiny, which continues to impact OpenAI, giving it a potential edge in navigating the political landscape.

Apple hits out at Meta's numerous interoperability requests

Apple and Meta are clashing over the EU's Digital Markets Act (DMA), which mandates interoperability between platforms. Apple criticized Meta’s 15 interoperability requests, claiming they risk user privacy and security, such as enabling Meta to access sensitive device data. Meta countered, accusing Apple of using privacy as a pretext for anti-competitive behavior. The EU Commission outlined measures for Apple's compliance, including timelines and a mechanism to resolve disputes. A compliance decision is expected by March 2025.

Google Contracts Employees From Magic Leap

Google has contracted over 100 Magic Leap employees to support its Android XR operating system development, intensifying its rivalry with Meta in mixed reality. This arrangement includes engineers, designers, and developers working under Magic Leap while collaborating with Google. Magic Leap, once a major player in AR/VR, has faced strategic struggles, layoffs, and dwindling consumer interest, pivoting to enterprise markets under CEO Ross Rosenberg.

Google’s counteroffer to the government trying to break it up is unbundling Android apps

Google proposed countermeasures to address the Department of Justice's antitrust concerns over its search monopoly, aiming to avoid breaking up key divisions like Chrome, Android, or Google Play. Its proposal focuses on changes to its search distribution contracts, including blocking deals that bundle Chrome, Search, and Google Play with preinstalled apps like Google Assistant or Gemini AI for three years. It also allows for multiple default search placement deals across platforms, revisited annually. While Google plans to appeal the ruling declaring it a monopoly, it will submit a revised proposal in March 2025 before a trial in April.

Amazon’s Project Kuiper is in talks with Taiwan to provide satellite internet, as the nation seeks alternatives to SpaceX due to Elon Musk’s ties to China and comments on Taiwan’s sovereignty. While Amazon’s lack of direct Chinese ties compared to Musk is appealing, it also has significant business interests in China, raising questions about its suitability as a partner. Taiwan, which struggles with bandwidth from its current deal with Eutelsat Oneweb, plans to eventually develop its own satellite internet system.

Instagram to make up more than half of Meta's US ad revenue in 2025, report shows

Instagram is projected to generate over half of Meta's U.S. ad revenue in 2025, driven by its growing focus on short-form videos like Reels. Users now spend two-thirds of their time on Instagram watching videos, attracting advertisers. A potential TikTok ban could further boost Instagram, potentially capturing over 20% of reallocated ad dollars. In 2024, Instagram's revenue came primarily from Feed (53.7%) and Stories (24.6%), with Reels and Explore expected to contribute 9.6% by 2025.

Tesla's 2024 deliveries growth might hinge on Musk's unorthodox Cybertruck

Tesla's 2024 delivery growth hinges on the Cybertruck's success, but challenges loom. The truck’s polarizing design and high prices—ranging from $75K to $120K—have deterred traditional truck buyers. Registrations fell from 5,428 in August to 4,039 in October, signaling weakening demand. Tesla is offering incentives like leasing discounts and immediate availability, indicating softening interest. Used Cybertrucks now take 75 days to sell, up from 27 in May, as supply outpaces demand. Analysts expect Tesla’s 2024 deliveries to remain flat at 1.81M vehicles, mirroring 2023 levels.

Tesla in talks with city of Austin over self-driving technology, Bloomberg News reports

Tesla is in early talks with Austin authorities to establish safety standards for its autonomous vehicle technology. The company showcased its "Cybercab," a driverless, pedal-less vehicle, in October, with plans to introduce "unsupervised" driver-assistance tech in California and Texas next year. Tesla’s Full Self-Driving (FSD) system, which still requires driver oversight, has faced regulatory challenges, but Texas’ minimal restrictions may ease the rollout.

Tesla recalling almost 700,000 vehicles due to tire pressure monitoring system issue

Tesla is recalling nearly 700,000 vehicles, including the 2024 Cybertruck, 2017-2025 Model 3, and 2020-2025 Model Y, due to a tire pressure monitoring system issue. The warning light may fail to remain illuminated, risking improperly inflated tires and potential crashes. Tesla will fix the issue via a free software update, with owner notifications starting February 15, 2025. This marks the Cybertruck's seventh recall this year, adding to Tesla's ongoing recall challenges, including over 4 million vehicles recalled for various issues in 2024 alone.

OpenAI o3 Breakthrough High Score on ARC-AGI-Pub

Waymo is sending autonomous vehicles to Japan for first international tests

Microsoft is testing live translation on Intel and AMD Copilot Plus PCs

Nvidia’s Deal to Buy Israel’s Run:ai Wins Unconditional EU Nod

Apple Deals With European Regulation by Blasting Meta

Google Offers to Tweak Apple Search Contract Following Loss in Monopoly Trial

Jury Sides With Qualcomm in Dispute With Arm Holdings

Meet the Startup Making GPUs More Secure for AI

AI ‘Roadkill’ Fears Haunt Traders Two Years After ChatGPT Debut

Elon Musk Unexpectedly Joined Donald Trump-Jeff Bezos Dinner

Apple’s $1 Billion Investment May Be Fleeting Win for Indonesia

Apple is working on a doorbell camera with Face ID

What the Last Triple-Witching of 2024 Could Mean For Your Stocks

Amazon workers on Staten Island join nationwide strike against retailer amid busy holiday season

Google reveals AI ‘reasoning’ model that ‘explicitly shows its thoughts’

Waymo still doing better than humans at preventing injuries and property damage

Instagram teases AI editing tools that will completely reimagine your videos

Alphabet’s Wing will deliver DoorDash by drone in Dallas-Fort Worth

Intel finally notches a GPU win, confirms Arc B580 is selling out after stellar reviews

Mark Zuckerberg says Threads has more than 100 million daily active users

TikTok CEO meets with Trump as the platform tries to avoid a ban

Snapchat is overhauling how influencers earn money on the platform

Arm CEO Rene Haas on the AI chip race, Intel, and what Trump means for tech

As robotaxi companies stumble in the US, China’s fleet is growing

Economists Boost 2025 US Inflation Forecast on Tariff Concerns

Stock funds witnessed biggest inflows ever in a week to Wednesday: BofA

US Growth Revised to 3.1% on Stronger Consumer Spending, Exports

Mortgage Rates Climb for First Time in a Month, Landing at 6.72%

US Services Activity Expands by Most in More Than Three Years

If you found this article valuable, I’d be grateful if you shared it with others who might also find it interesting. Thank you!