Apex Radar - Week 50

December 9 - December 15 2024

Weekly check of the market

Magnificent 7, Nasdaq and S&P500

The AI era seems to have taken everyone by surprise, with so much happening that it’s almost impossible to keep up with all the information circulating. We’re constantly seeing records in the markets, making it crucial to consolidate and understand these developments on a weekly basis. Without this approach, we risk being overwhelmed by processing details daily, with no opportunity to take a longer-term perspective.

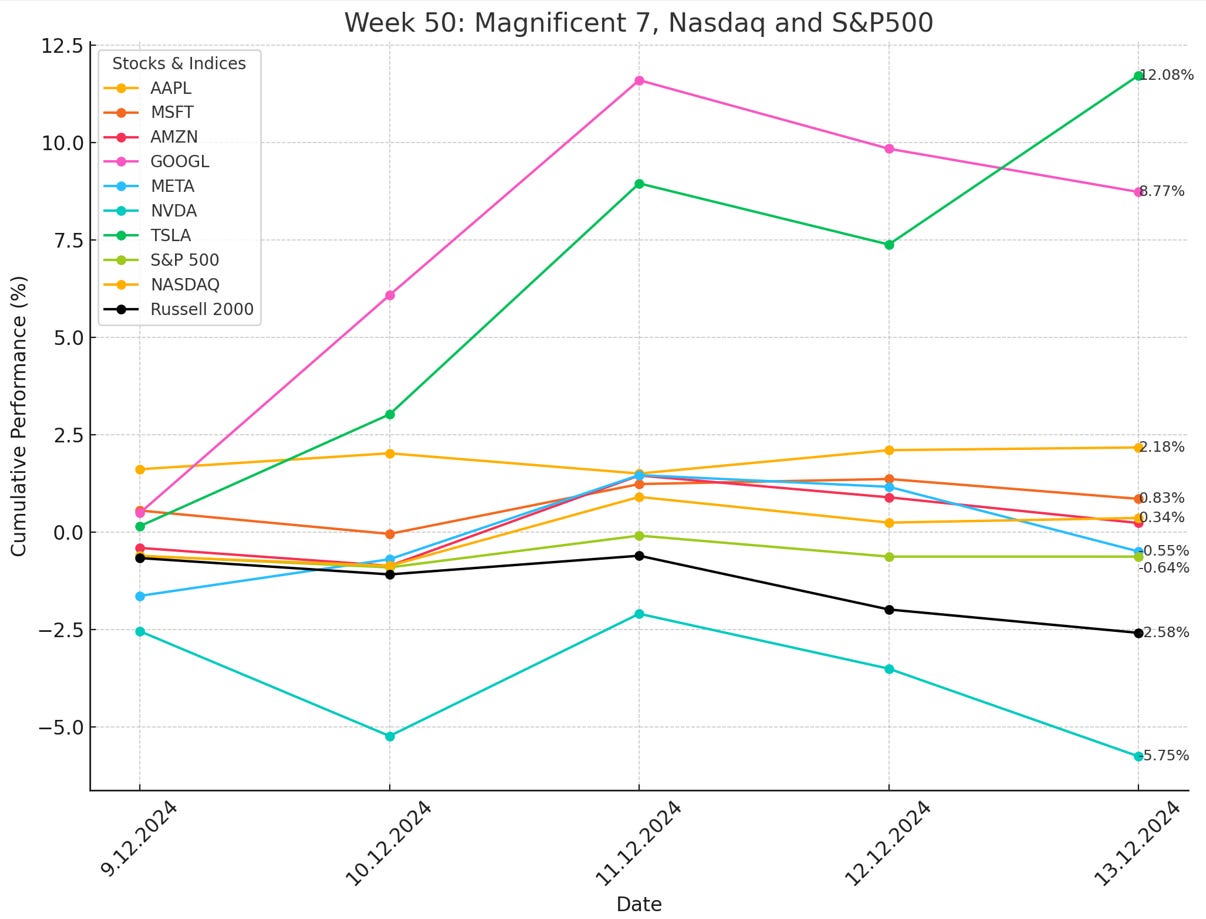

Tesla shows no signs of slowing down, with Elon Musk leading the charge as the company outshines the "Magnificent 7" and claims the spotlight this week. The stock soared an impressive 12.08%, fueled by strong weekly insurance registrations in China, boosting investor confidence. Additionally, analysts raised their price targets, further driving the stock's surge.

Google surged 8.77% this week, fueled by major advancements, including the unveiling of its quantum computing chip, Willow, and upgrades to key initiatives like Project Astra and Project Mariner.

Microsoft posted a modest 0.83% gain, driven by AI developments and an intriguing interview where Satya Nadella revealed they are not supply-constrained for chips. This wasn’t great news for Nvidia, which saw its stock drop 5.75% this week.

Amazon remained mostly flat, with a slight increase of 0.19%, as the company shared new details about its collaboration with Hyundai.

Apple announced its latest iOS upgrades and plans for thinner, foldable iPhones aimed at reviving growth. The news was well-received by the market, pushing the stock up by 2.18%.

Meta faced technical issues on Wednesday, leaving users unable to access its services. Despite the disruption, the stock saw no significant movement, ending the week down 0.55%.

The S&P 500 declined by 0.64% after hitting an all-time high last Friday, suggesting a brief stabilization phase. Increased volatility may emerge next week with expectations of a Fed rate cut. The NASDAQ gained 0.34%, reflecting similar trends but outperforming the S&P 500 on Wednesday.

After pushing above its all-time high last week, Bitcoin experienced a drop on Monday and Tuesday. However, similar to broader financial markets, it rebounded on Wednesday, closing above $100K. Bitcoin is surging again by week’s end, crossing $103K as I write this.

Fear & Greed Index

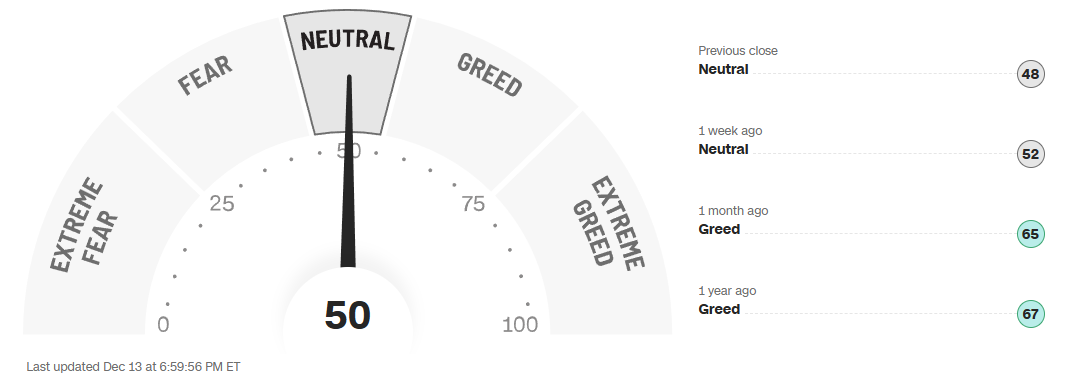

We observe a continuation from the previous week with stabilization in market volatility. Record market levels contribute to this steadiness, and President Trump's visit to traders this week has reinforced confidence that efforts will be made to maintain market calm moving forward.

CBOE Volatility Index (VIX)

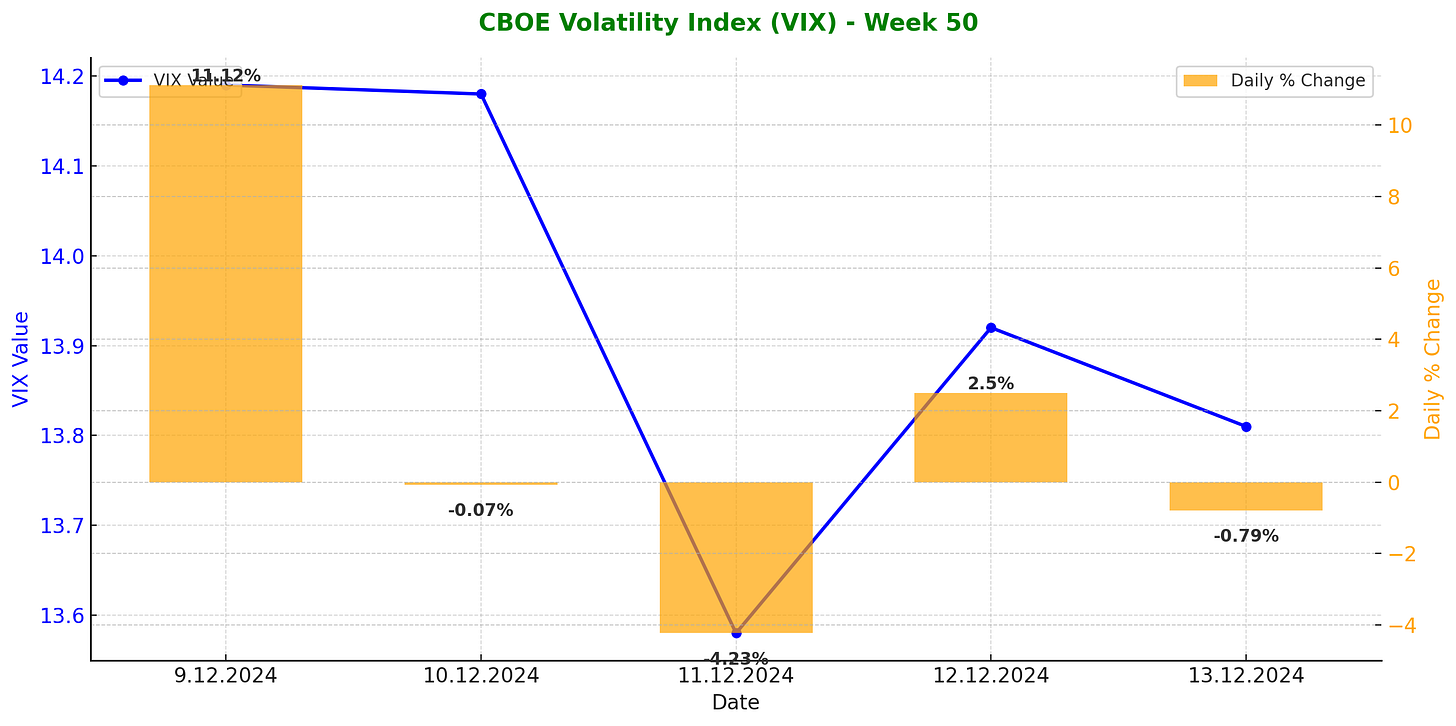

The VIX rose 8.14% in Week 50, driven by an 11.12% spike Monday as U.S. stocks retreated after record highs Friday. The November jobs report boosted expectations for a December Fed rate cut. After the volatility on Monday, new records were set in both the S&P 500 and Nasdaq later in the week.

Earnings of the week

C3.ai

C3.ai shares fluctuated after strong Q2 results, with 29% YoY revenue growth to $94.4M, surpassing forecasts. Key highlights include a new Microsoft partnership extending to 2030, offsetting uncertainty about its Baker Hughes deal. Despite improving margins, C3.ai remains unprofitable, with stock-based compensation diluting shares. While the Microsoft deal is promising, weak SaaS margins and valuation concerns make the stock less appealing.

Oracle

Oracle shares fell nearly 7%, their steepest drop in 2024, after Q2 earnings missed estimates. Revenue rose 9% YoY to $14.06B, below expectations, while adjusted EPS of $1.47 missed by a penny. Cloud services revenue grew 12% to $10.81B, with cloud infrastructure surging 52%, driven by AI demand. Oracle partnered with Meta for AI projects, boosting optimism. Analysts remain bullish, citing strong cloud momentum and raising price targets.

MongoDB

MongoDB reported strong Q3 results, with revenue up 22% YoY to $529.4M, surpassing estimates of $497.65M, and EPS of $1.16 beating expectations of $0.67. Growth was driven by large multi-year on-premise deals and 26% growth in Atlas revenue. The company raised fiscal 2025 guidance for EPS to $3.01-$3.03 and revenue to $1.973B-$1.977B. COO and CFO Michael Gordon will step down in January, with a search for his replacement underway. Shares fell 3% post-earnings call.

Adobe

Adobe shares dropped 14%, their steepest decline since 2022, after issuing disappointing Q1 revenue guidance of $5.63-$5.68B, below analyst expectations of $5.73B. Despite the guidance, Q4 results exceeded forecasts, with EPS of $4.81 and revenue up 11% to $5.61B. Analysts praised Adobe's AI monetization efforts, like Firefly, but some lowered ratings and targets, citing concerns about 2024 performance.

Broadcom

Broadcom shares rose 13% after reporting Q4 earnings that beat expectations, with EPS of $1.42 vs. $1.38 estimated, though revenue slightly missed at $14.05B vs. $14.09B expected. AI revenue soared 220% YoY to $12.2B, driven by demand for generative AI infrastructure and custom AI chips. CEO Hock Tan forecasted a $60B-$90B AI market by 2027. Broadcom also announced an 11% dividend increase for fiscal 2025.

Costco

Costco beat Q1 estimates with EPS of $4.04 vs. $3.79 expected and revenue of $62.15B. Net income rose to $1.8B, driven by strong sales in jewelry, luggage, and furniture, alongside a 13% jump in e-commerce. Comparable sales grew 5.2%, with fresh and meat categories performing well. Membership revenue rose 8% YoY, despite a slight renewal rate dip. Costco plans 29 new clubs this year and continues to gain market share online. Shares are up nearly 50% YTD.

News of the week

Trump rings bell at NYSE to cheers of ‘USA’ as Wall Street CEOs, business leaders look on

President-elect Donald Trump rang the NYSE bell, promising an economic boom under his administration. Flanked by key allies and business leaders, he vowed tax cuts, incentives for U.S. manufacturing, and policies to lower inflation. Trump highlighted strong market gains and collaborations with influential CEOs like Elon Musk and Mark Zuckerberg.

Annual inflation rate accelerates to 2.7% in November, as expected

November CPI rose 2.7% YoY and 0.3% MoM, with Core CPI at 3.3% YoY. Shelter costs, up 0.3%, drove 40% of the rise. Food rose 0.4% MoM; energy 0.2% MoM but down YoY. Used car prices rebounded 2%. While inflation is well off the 40-year high it saw in mid-2022, it remains above the Fed’s 2% annual target.

Google reveals quantum computing chip with ‘breakthrough’ achievements

Google unveiled its new quantum computing chip, Willow, which completed a task in under five minutes that would take a supercomputer 10 septillion years. The 105-qubit chip achieved a breakthrough in error correction, reducing errors while scaling qubits, a major hurdle in quantum computing. Google aims to use this technology for AI, medicine, energy innovation, and more, positioning quantum as a transformative tool for real-world applications.

Facebook, Instagram and other Meta apps go down due to ‘technical issue’

Meta’s family of apps, including Facebook, Instagram, WhatsApp, Threads, and Messenger, experienced a widespread outage on Wednesday, starting at 9:57 a.m. PST and peaking with over 100,000 user reports by 10:11 a.m. Meta acknowledged the issue, citing a technical problem, and worked throughout the day to restore services. Instagram and other apps were fully operational after several hours. A similar outage occurred in March 2024.

Ad giant Omnicom takes aim at Big Tech, AI era with $13 billion Interpublic deal

Omnicom Group has announced a $13.25 billion all-stock deal to acquire Interpublic Group, forming the world's largest ad agency to better compete with Big Tech. Interpublic shareholders will receive a 21.6% premium. The deal, expected to close in 2025, faces potential regulatory scrutiny.

Meta asks the government to block OpenAI’s switch to a for-profit

Meta has joined Elon Musk in urging California's attorney general to block OpenAI's transition to a for-profit model, arguing it sets a dangerous precedent for nonprofit startups benefiting from tax advantages. OpenAI defends its restructuring, emphasizing a nonprofit arm will retain its mission and ownership stake. Musk, an OpenAI co-founder turned critic, has accused the company of abandoning its original nonprofit ideals for profit. The debate underscores tensions in Silicon Valley’s AI sector.

Amazon’s online car ‘dealership’ with Hyundai is now live

Amazon has launched Amazon Auto, its online car shopping platform, in partnership with Hyundai. Customers in 48 US cities can browse, finance, and purchase Hyundai vehicles through Amazon, with delivery and trade-ins managed by dealers. While Hyundai is the exclusive launch partner, Amazon plans to expand its offerings. Buyers will also receive a $2,300 gift card for purchases made before January 10, 2025.

Google’s AI enters its ‘agentic era’

Google announced updates to its AI projects, Project Astra and Project Mariner, marking the start of its "agentic era." Astra, a virtual assistant that processes text, images, and audio, is expanding to more testers and integrating into products like Search and Maps. Mariner, a Chrome extension, automates browser tasks but is still slow. Google aims to refine these tools for practical, supervised use.

Apple Plans Thinner, Foldable iPhones to Revive Growth

Apple plans significant updates to its iPhone lineup, including a thinner model and two foldable devices: a foldable iPhone and a larger foldable screen akin to a laptop. The foldables, expected by 2026-27, face technical hurdles like hinge and display improvements. Apple is also exploring updates to its Vision Pro headset, possibly integrating iPhone processing to reduce cost and weight. With iPhone revenue growth under 1% in fiscal 2024, these innovations aim to revive demand and drive sales growth.

iOS 18.2 Review: The AI Apple Promised Us

Apple's iOS 18.2 introduces its first major AI features, exclusive to iPhone 15 Pro and 16 models. Highlights include Genmoji, a fun emoji creator; Visual Intelligence, which uses AI for camera-based queries; and Siri’s integration with ChatGPT for advanced tasks. The update is playful yet practical, but its hardware restrictions may leave most users waiting for broader accessibility.

ServiceTitan prices IPO at $71, above expected range, after slow stretch for tech offerings

ServiceTitan, a cloud software provider for contractors, priced its IPO at $71 per share, above the expected range, raising nearly $625M and valuing the company at $6.3B. Trading under “TTAN” on Nasdaq, the company saw 24% YoY revenue growth in Q3 to $198.5M but reported a net loss of $47M. Founded by sons of contractors, its software modernizes marketing, sales, and customer service for trades businesses. Key backers include Bessemer and TPG.

Amazon is bringing Intuit QuickBooks software to its millions of third-party sellers

Amazon will integrate Intuit QuickBooks into Seller Central by mid-2025, offering real-time financial insights and loans via QuickBooks Capital. This supports Amazon's seller-focused strategy, with seller services revenue rising 10% in Q3. Intuit enhances tools with AI for growth.

Tech companies most threatened by Trump are donating to his inauguration fund

Tech leaders and companies, including Meta, Amazon, and OpenAI, pledged $1M each to Trump’s inauguration fund, signaling efforts to curry favor as Trump re-enters the White House. Despite past tensions, figures like Zuckerberg, Bezos, and Altman aim to shape AI regulation, competing with Musk's growing influence under Trump’s administration.

Apple and Google instructed by House committee to prepare to dump TikTok next month

House lawmakers have warned Apple and Google to prepare for a potential TikTok ban in the U.S. if ByteDance fails to divest by Jan. 19, as mandated by a recent court ruling. The law prohibits app store operators from supporting TikTok if the divestment doesn't occur. TikTok plans to appeal to the Supreme Court, citing First Amendment concerns.

Broadcom’s long and winding path to the trillion-dollar club, and how Trump played a role

Broadcom shares soared 24%, hitting a $1T market cap for the first time, driven by strong Q4 earnings and booming AI revenue, up 150% YoY to $3.7B. The company has shifted from a semiconductor focus to a balanced portfolio, with infrastructure software now 41% of revenue, boosted by its $61B VMware acquisition. Custom AI chips for major tech firms like Meta and Alphabet position Broadcom as a key player in the AI hardware space, rivaling Nvidia's growth in the sector.

TSMC says first advanced U.S. chip plant ‘dang near back’ on schedule.

TSMC's first advanced U.S. chip fab in Arizona, originally delayed, is now "dang near back" on schedule. The $20B facility will produce 4nm chips by 2025, with plans for two more fabs by 2030, totaling a $65B investment. The site addresses supply chain risks and U.S. chip self-reliance, hiring 6,000 workers and using renewable energy credits to offset its massive power demands. TSMC aims to broaden its global footprint with additional fabs in Japan and Germany.

TikTok failed to save itself with the First Amendment

The court upheld a TikTok divest-or-ban law, citing bipartisan national security concerns about Chinese influence. Judges rejected TikTok's First and Fifth Amendment challenges, emphasizing that divestiture, not mitigation plans like Project Texas, was necessary. Critics argue the decision risks enabling government overreach, but the ruling stressed reliance on Congress and executive assessments. TikTok plans to appeal to the Supreme Court.

Waymo’s robotaxis pass the first responder test

Waymo's robotaxis passed an independent review by Tüv Süd, confirming they meet industry standards for emergency protocols, including detecting emergency vehicles and responding to hand signals. Waymo has trained 15,000 first responders and released detailed guides for handling its vehicles. Despite some incidents, the company emphasizes safety as it expands, aiming to prevent setbacks like those faced by Cruise and Uber.

Intel executives hint at potential manufacturing spinoff

Intel is navigating a critical transition following the ousting of CEO Pat Gelsinger, with interim co-CEOs hinting at a potential manufacturing spinoff. Intel has already begun separating its manufacturing operations into a standalone subsidiary but hasn’t confirmed a full split. The decision, influenced by $8 billion in CHIPS Act funding oversight, could reshape Intel into a chip design-focused company like its rivals. Upcoming challenges include its 18A process, critical to competing with TSMC and AMD.

Epic Games is partnering with Telefónica to preinstall the Epic Games Store on millions of Android phones, including Samsung devices, across the UK, Germany, Spain, and Latin America. This marks the first time the store will be preinstalled on consumer phones, challenging Google Play's dominance. The move follows a recent court ruling limiting Google’s ability to block alternative app stores.

The end of Cruise is the beginning of a risky new phase for autonomous vehicles

GM has ended its $10 billion robotaxi experiment, citing high costs and regulatory challenges. Instead, the company will focus on privately owned autonomous vehicles, leveraging its Cruise technology to enhance driver-assistance systems. CEO Mary Barra believes personal autonomy aligns better with customer desires and GM’s strengths. However, safety risks with Level 3 automation remain significant, and GM could revisit robotaxis in the future as the technology matures.

It sure sounds like Google is planning to actually launch some smart glasses

Google's Project Astra, its ambitious AI virtual assistant, is being tested on prototype smart glasses as part of Google's Trusted Tester program. These glasses aim to provide an intuitive, always-on experience for tasks like navigation, weather updates, and more. While Astra's capabilities align well with wearable tech, details on a public launch remain unclear. Google's commitment to smart glasses suggests a strong push toward integrating AI into everyday life.

Elon Musk is mad at the SEC again

Breaking Up Google Could Make Rival Browsers’ Life Worse

Google Challenger Perplexity Promises Booming Growth, Rosy Margins

Google Asks FTC to Kill Microsoft’s Exclusive Cloud Deal with OpenAI

Sundar Pichai and Jeff Bezos head to Mar-a-Lago to schmooze with Trump

Tesla China Demand Hot; Key Analyst Raises Price Target But It's Not On Deliveries

Tim Cook is the latest tech CEO to meet with Trump at Mar-a-Lago

Microsoft’s AI boss and Sam Altman disagree on what it takes to get to AGI

Google says its breakthrough quantum chip can’t break modern cryptography

Google launched Gemini 2.0, its new AI model for practically everything

Solos challenges Meta’s Ray-Bans with $299 ChatGPT smart glasses

Meta’s new Quest update has faster hand tracking and at-a-glance PC connections

OpenAI has finally released Sora

How Anthropic Got Inside OpenAI’s Head

Biden administration raises tariffs on solar materials from China

Amazon and the endangered future of the middle manager

Michael Dell Spent 40 Years Preparing for an AI Boom No One Expected

Google announces Android XR, a new OS for headsets and smart glasses

Google’s future data centers will be built next to solar and wind farms

Over $6 billion in CHIPS Act funding finalized for Micron plants in the US

Instagram will let creators test experimental reels on random people

Rebels assert control after Assad regime collapse

OpenAI’s New Toy Could Be a Problem

Next week

The Federal Reserve's final meeting of 2024 is set for December 17-18, with markets widely anticipating a quarter-point rate cut. If implemented, this would mark a total of 100 basis points in cuts over the past three meetings. However, with solid economic growth and persistent inflation, investors expect the Fed to hold rates steady through next spring.

If you found this article valuable, I’d be grateful if you shared it with others who might also find it interesting. Thank you!