Apex Radar - Week 48

November 25 - December 1 2024

Weekly check of the market

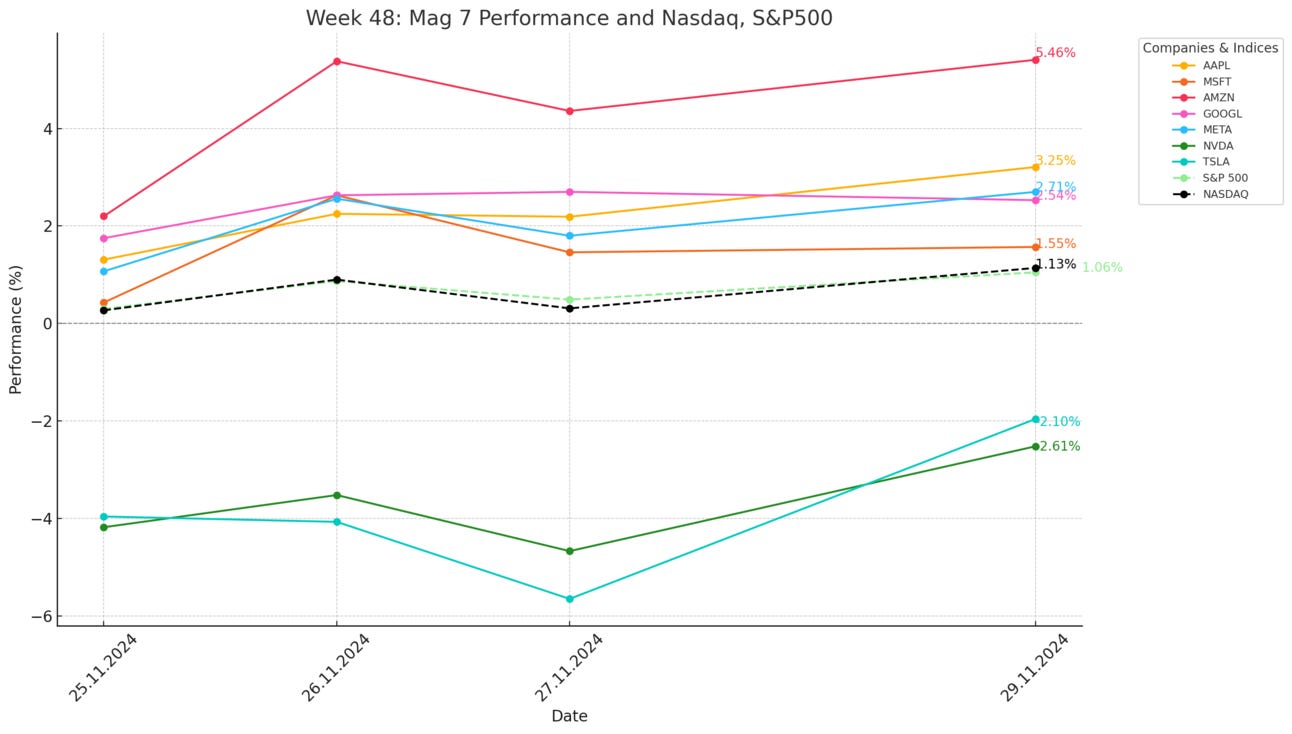

Magnificent 7, Nasdaq and S&P500

Apple posted strong gains of 3.25%, likely fueled by optimism about its product ecosystem, as highlighted by Wedbush analysts, who noted the strength of its vast iOS device base and services growth. Additionally, Black Friday expectations for record-breaking shopping activity, particularly for products like AirPods, iPads, and Apple Watches, contributed to the positive investor sentiment.

Microsoft gained 1.55%, reflecting steady growth in the cloud and AI.

Amazon surged by 5.46% a, emerging as the "winner of the week" due to its announcement of a new generative AI model and strong Q4 holiday season predictions, alongside optimism regarding AWS's growth and AI services.

Google gained 2.54%, as investors showed resilience despite uncertainties surrounding ongoing DOJ antitrust lawsuits. Different analysts' sum-of-parts valuations have highlighted that even if Google were split into separate entities due to antitrust pressures, the combined value of its divisions—Search, GCP, YouTube, Android, Chrome, and others could exceed its current market valuation, further boosting investor confidence.

Meta rose 2.71%, driven by advancements in its ambitious cable project aimed at enhancing global internet infrastructure, including plans to build a $10 billion, globe-spanning undersea internet cable to improve connectivity and reduce reliance on telecom companies. Investor confidence was further bolstered by Meta's continued focus on AI and metaverse initiatives, as well as strategic engagement by CEO Mark Zuckerberg, who recently met with President-elect Donald Trump at Mar-a-Lago to discuss the incoming administration and its economic reforms. Zuckerberg expressed gratitude for the opportunity, signaling Meta's proactive approach to navigating regulatory and political landscapes.

Nvidia dropped by 2.61% this week, as fears of a potential trade war and the announcement of new tariffs weighed heavily on investor sentiment.

Tesla declined by 2.10%, potentially reflecting cautious investor sentiment despite significant advancements in its robotics and neural interface ventures. The unveiling of an upgraded hand for the Optimus humanoid robot, which demonstrated enhanced dexterity by catching a tennis ball, showcased Tesla's progress in developing humanoids with near-human capabilities. Additionally, Neuralink, another venture led by Elon Musk, received FDA approval for its CONVOY Study, aiming to connect its brain-computer interface (BCI) N1 Implant to assistive robotic arms.

The S&P 500 gained 1.06%, reaching an all-time high, underscoring strength in the broader market driven by easing inflation concerns, robust corporate earnings, and optimism in tech. The NASDAQ rose 1.13%, mirroring tech-heavy gains as innovation-driven growth sectors continued to thrive.

After coming within 1% of the $100K mark last week, Bitcoin appears to have entered a consolidation phase, with this week's trading range fluctuating between $90K and $99K. It is currently trading at $96,924.

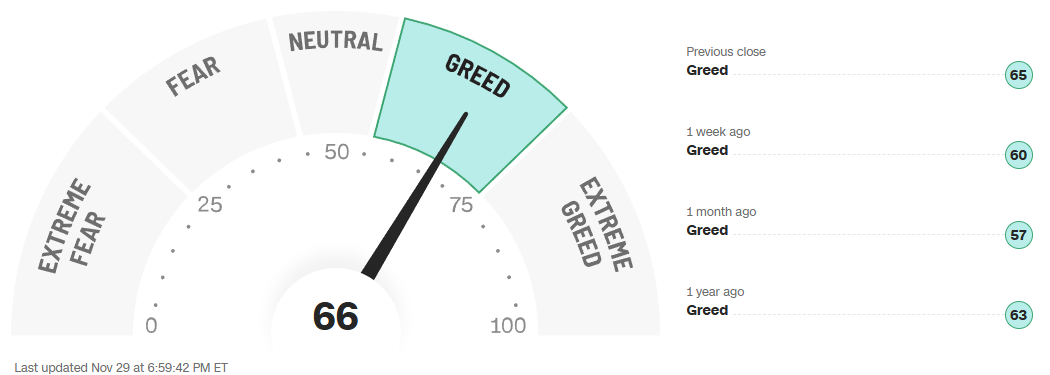

Fear & Greed Index

It appears that market sentiment is leaning further into greed, as indicated by the Fear and Greed Index climbing to 66 from last week's 60. With the holiday season approaching, optimism and bullish sentiment seem to be driving this upward shift.

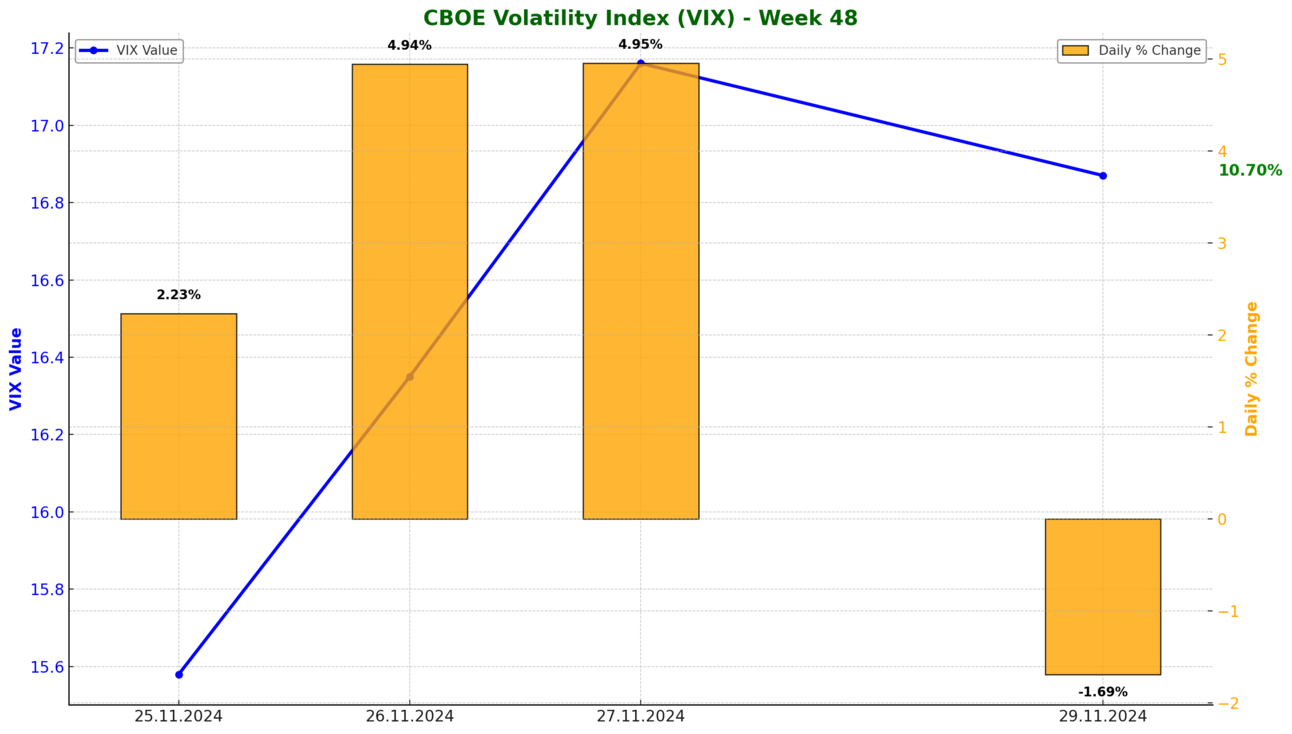

CBOE Volatility Index (VIX)

The VIX rose 10.70% in Week 48, reflecting heightened market uncertainty. Daily spikes, like a 4.95% rise on 27.11.2024, suggest investor fear. This volatility may stem from tariffs announced by Trump, sparking hedging activity and risk aversion.

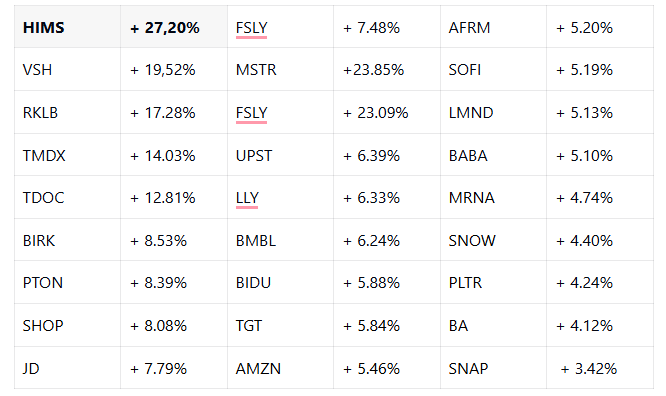

Outliers

Next week, I’ll focus on the top 15 performers and laggards with a market cap above $10B, as these are my primary investment targets. Interestingly, many names appear in the table for the second time, highlighting the current appeal of growth-oriented companies.

Earnings of the week

Zoom

Zoom delivered strong Q3 results, beating expectations with EPS of $1.38 (vs. $1.31) and revenue of $1.18B (vs. $1.16B), up 4% YoY. Net income rose to $207M, while enterprise customers grew to 192,400. FY 2025 guidance increased to $4.66B revenue and $5.43 EPS. The company introduced new offerings like single-use webinars for up to 1M attendees and a premium AI Companion launching in 2025. Shares fell 4% post-earnings due to modest Q4 guidance but remain up 24% YTD. Zoom also rebranded to "Zoom Communications Inc." to reflect its AI-driven evolution.

Dell

Dell beat Q3 EPS expectations with $2.15 (vs. $2.06) but missed on revenue at $24.4B (vs. $24.67B). Net income rose 12% to $1.12B. Infrastructure Solutions Group revenue surged 34% to $11.4B, driven by AI server sales, while PC sales dipped 1% to $12.1B. Q4 guidance fell below estimates, sending shares down 10%.

CrowdStrike

CrowdStrike reported Q3 revenue of $1.01B, up 29% YoY, exceeding estimates. However, rising costs led to a net loss of $16.82M, or $0.07/share, compared to a $26.67M profit last year. Costs stemmed from a July software outage, which sparked lawsuits like Delta's $500M claim. Despite challenges, CrowdStrike raised FY revenue guidance to $3.92B-$3.93B, above expectations. Shares fell 2% post-earnings but remain up 42% YTD and many analysts still bullish.

HP

HP reported Q4 revenue of $14.1B, up 1.7% YoY, beating estimates of $13.99B. Adjusted EPS of $0.93 met expectations. However, Q1 2025 EPS guidance of $0.70-$0.76 fell below analyst expectations of $0.85, reflecting continued weak PC demand. FY 2025 EPS guidance of $3.45-$3.75 aligns with forecasts.

Workday

Workday reported Q3 EPS of $1.89 (vs. $1.76 expected) and revenue of $2.16B (vs. $2.13B expected), up 16% YoY. Subscription revenue grew to $1.96B. However, Q4 guidance missed expectations with a 25% margin and $2.03B subscription revenue forecast, sending shares down 11%. FY 2026 subscription revenue is projected at $8.8B (+14%).

News of the week

President-elect Trump announced plans for 25% tariffs on imports from Canada and Mexico and an additional 10% tariff on Chinese goods, impacting over one-third of U.S. imports. Justified under IEEPA, the measures target drug trafficking but may prompt retaliatory tariffs. Businesses should act quickly to mitigate risks by accelerating shipments, sourcing alternatives, or using customs valuation strategies like the "first sale rule."

Tesla's Optimus Bot Gets New Hands As Neuralink's FDA-Approved BCI Trials Begin

Tesla unveiled upgraded hands for its Optimus robot, capable of catching objects, aligning with Neuralink's FDA-approved BCI trials to test robotic arm control.

Meta plans to build $10B globe-spanning undersea internet cable

Meta plans to invest over $10 billion to lay 25,000 miles of private undersea fiber optic cables, spanning the US, India, South Africa, and Australia. The cables, aimed at supporting Meta's significant internet usage (22% of global mobile traffic), will face logistical hurdles before implementation.

Databricks is raising $5-$8 billion at a $55 billion valuation, enabling employees to cash out while delaying an IPO until at least mid-2025. Backed by major firms like Nvidia and Fidelity, the AI-driven data analytics company projects $2.4 billion in 2024 revenue and continues to expand amid strong AI momentum.

Brazil's income tax exemption plan sends currency to fresh lows

Brazil's government announced over 70 billion reais ($11.8 billion) in spending cuts to support its fiscal framework, alongside tax reforms increasing income tax exemptions for the middle class, surprising markets. Investors reacted negatively, citing optimistic fiscal projections, causing the real to weaken to 5.99 per dollar, interest rate futures to rise, and the Bovespa index to drop 2%. Measures include higher taxes on the wealthy and ending exemptions for retirees with high incomes, but concerns remain over credibility, with analysts expecting further interest rate hikes.

Brazil's finance minister, Congress leaders seek to calm markets on tax change concerns

Brazil's currency rebounded from record lows after congressional leaders delayed income tax reform, focusing instead on immediate spending cuts to save 70 billion reais ($11.8 billion) over two years. Finance Minister Haddad reaffirmed commitment to reducing the deficit and achieving 327 billion reais in savings by 2030. Market skepticism remains over fiscal credibility, despite alignment between the Lula administration and Congress on budget discipline. The real ended Friday at a record low of 6 per dollar, with central bank officials emphasizing a floating exchange rate policy.

Amazon Develops Video AI Model, Hedging Its Reliance on Anthropic

Amazon is set to launch Olympus, a multimodal AI model capable of analyzing video, images, and text, potentially debuting at AWS re:Invent. Targeting industries like sports analytics and oil and gas, Olympus aims to enhance video search and inspection efficiency. While less advanced in text generation than rivals like OpenAI, its video-processing capabilities could attract customers. Amazon’s investment in in-house AI reflects its strategy to reduce reliance on Anthropic and rivals.

Breaking down the DOJ’s plan to end Google’s search monopoly

The DOJ has proposed significant remedies to break up Google’s search monopoly, including selling Chrome and its Chromium project, banning exclusionary deals with Apple, and syndicating search data to competitors. These moves could disrupt Google’s ad revenue and search dominance, but Google’s core assets like Android and YouTube remain intact.

US 'Black Friday' online spending put at record $10.8 bn

American consumers spent a record $10.8B online during Black Friday, up 10.2% YoY, driven by toys, electronics, and apparel. AI-powered shopping tools boosted site traffic by 1,800%. Adobe predicts $40.6B in total online sales for the 5-day period, with Cyber Monday expected to hit $13.2B, up 6.1% YoY.

Meta CEO Mark Zuckerberg met with President-elect Donald Trump at Mar-a-Lago, reportedly to discuss the incoming administration. A Meta spokesperson called it an important time for innovation, while Trump advisor Stephen Miller praised Zuckerberg's interest in supporting national renewal under Trump’s leadership. Despite past tensions, the meeting was described as cordial.

ByteDance’s Global AI Ambition Runs Into Obstacles

ByteDance is developing AI models for global markets, aiming to reduce reliance on OpenAI while navigating geopolitical and regulatory challenges, particularly in the U.S. Its Doubao chatbot leads in China with 51.3M users, while Cici AI has launched in Southeast Asia, Latin America, and Japan. Technical hurdles and legal compliance remain obstacles for its global LLM rollout.

Ramp Seeks Valuation Bump to $11 Billion in Share Sale

Nvidia Slips Again On Post-Earnings Blues, New China Trade War

Nvidia shares fell 1.2% to $135.34, dropping below the 50-day average amid post-earnings "digestion" and fears of a potential trade war under President-elect Trump. While analysts see minimal direct impact from tariffs on semiconductors, broader trade tensions could pose risks. Nvidia maintains a dominant 18-24 month lead in AI GPUs, with no major challengers yet.

Tesla shares rose 1.8% Friday after Wedbush analyst Dan Ives projected Tesla’s AI and autonomous driving opportunity could reach $1 trillion. Ives highlighted Elon Musk’s influence with President-elect Trump and anticipated eased regulations for self-driving cars. Tesla remains Wedbush's top AI play with a $400 price target.

Apple bears have missed out on more than $1 trillion of stock gains, says this bull

Apple skeptics have missed a $1 trillion stock surge as Wedbush's Dan Ives predicts strong growth ahead. With a $2T services business and AI integration set to reach 20% of the global population, Apple targets 240M iPhone sales in FY25. Wedbush maintains a $300 price target, 28% above current levels.

If you found this article valuable, I’d be grateful if you shared it with others who might also find it interesting. Thank you!