Apex Radar - Week 2

January 6 - January 10 2024

Weekly check of the market

Magnificent 7, Nasdaq and S&P500

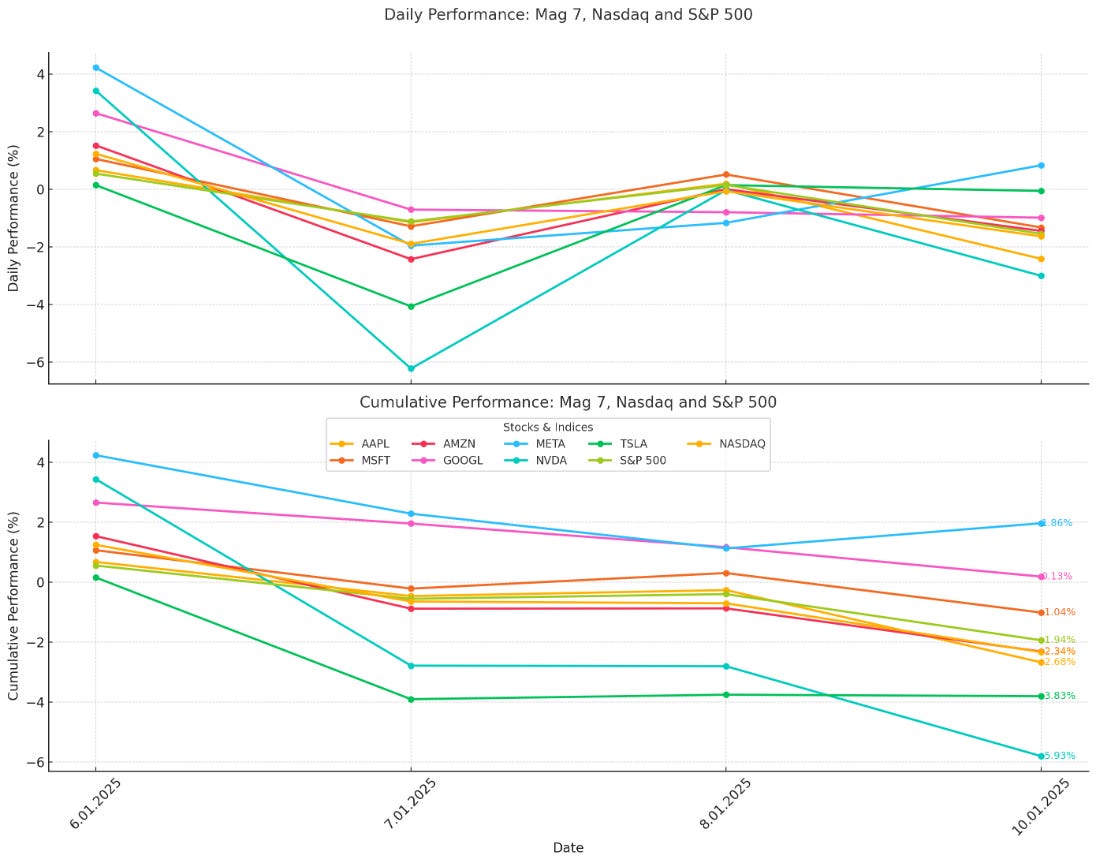

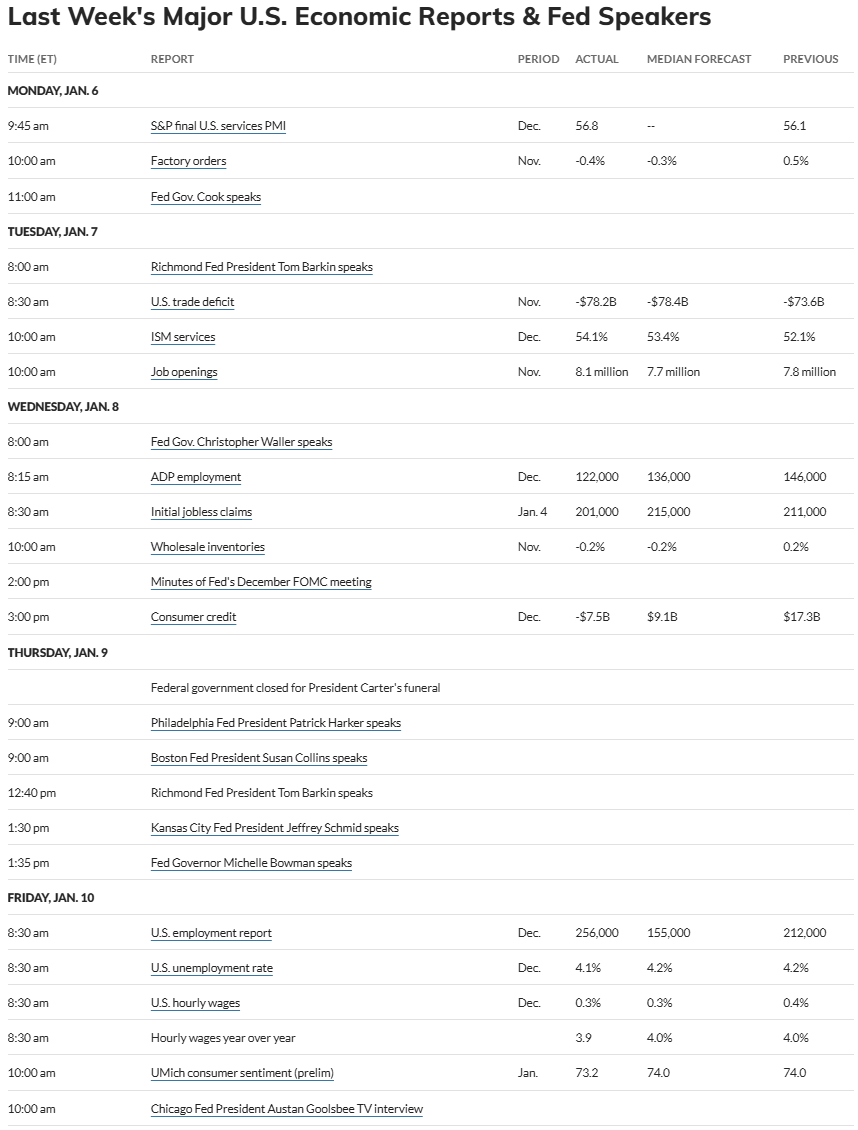

This week, financial markets were shaped by macroeconomic events, notably the December jobs report, which surpassed expectations. Employers added 256,000 jobs, well above analysts’ forecast of 160,000, while the unemployment rate dropped to 4.1% from 4.2% in November, according to the Labor Department. The strong labor market data suggests fears of a weakening job market were premature, easing the urgency for the Federal Reserve to implement rate cuts. Amid this backdrop, the Nasdaq declined 2.34%, and the S&P 500 fell 1.94%, reflecting the broader market’s cautious sentiment.

Meanwhile, the U.S. Treasury yield curve steepened notably, with 10-year yields climbing 17 basis points to 4.77% and 30-year yields rising 14 basis points to 4.96%, briefly crossing the 5% threshold for the first time in over a year. This selloff in long-term bonds was driven by stronger-than-expected economic data and fiscal uncertainty linked to the incoming Trump administration. Proposals such as border taxes and large-scale deportations could exacerbate inflationary pressures by raising costs or wages. Bank of America highlighted the potential for an additional Fed rate hike, while traders are increasingly pricing in the possibility of 10-year yields reaching 5%, underscoring heightened caution in fixed-income markets.

Crude prices close at highest level since October after U.S. imposes Russia oil sanctions. Oil prices jumped on Friday after the U.S. Treasury Department announced sweeping sanctions against Russia’s oil industry.

Beyond the macroeconomic events dominating the markets, the tech sector saw significant developments, including NVIDIA CEO Jensen Huang's highly anticipated 90-minute keynote at CES 2025. Huang unveiled groundbreaking innovations across gaming, autonomous vehicles, robotics, and agentic AI, reinforcing NVIDIA's leadership in cutting-edge technology. However, despite an impressive 3.43% surge on Monday as CES kicked off, NVIDIA's stock faced a sharp reversal, closing the week down 5.93%. This made it the weakest performer among the Magnificent 7, reflecting heightened investor caution despite the company's continued innovation.

The standout performer of the week was Meta, which closed up 1.86% on a weekly basis, compared to Google's modest gain of 0.13%, making them the only two members of the Magnificent 7 to post positive weekly returns. Meta's outperformance was primarily driven by Friday's Supreme Court hearing on TikTok. Reports indicated that the Court appeared likely to uphold a law that could ban TikTok in the U.S. starting Jan. 19 unless its China-based parent company, ByteDance, sells the app. While sentiment around this scenario remains mixed, the potential market shift away from TikTok has created optimism around Meta's platforms.

In addition, Meta made headlines with several other notable developments. UFC President Dana White joined Meta's Board, bringing a unique perspective to the company's leadership. Meanwhile, eBay began trialing listings on Facebook Marketplace, following EU antitrust pressures on Meta's business practices. Perhaps most significantly, Meta announced it would end fact-checking and lift restrictions on speech across Facebook and Instagram, a move that could reshape content moderation strategies and further define the platform’s direction.

Tesla was the second-largest laggard of the week, posting a 3.83% decline, reflecting the broader pressure on high-valuation stocks as markets adjust to rising yields and economic uncertainty. High-multiple companies like Tesla appear particularly vulnerable to downturns under current conditions.

Meanwhile, Apple experienced a 2.68% decline on a weekly basis, despite upbeat news from Foxconn, a key supplier and assembler for both Apple and Nvidia. Foxconn reported an impressive 15% year-over-year increase in quarterly revenue, reaching $64.75 billion, highlighting strong demand across its client base. However, Apple’s stock struggled, potentially due to broader market pressures or, as some might speculate, investor reactions to Tim Cook’s recently announced pay increase. 😉

Microsoft also faced headwinds, slipping 1.04% on the week. The company announced plans to invest $3 billion over the next two years to expand its cloud and artificial intelligence infrastructure in India, underscoring its long-term commitment to AI and emerging markets. However, the announcement was not enough to offset broader market pressures weighing on the tech sector

Amazon announced ambitious plans to invest at least $11 billion in expanding its cloud and AI infrastructure in Georgia, underscoring its strategic push into artificial intelligence. Additionally, positive news emerged regarding Anthropic, an Amazon-backed OpenAI rival. After being valued at $18 billion last year, reports now suggest Anthropic is in advanced talks to raise $2 billion, potentially pushing its valuation to an impressive $60 billion. However, despite these developments highlighting Amazon's growing AI footprint, the company's stock declined 2.34% on a weekly basis, reflecting broader market pressures on tech stocks.

Bitcoin mirrored broader market conditions, experiencing a price decline from $98.000 the previous week to around $94.000 by Sunday’s close. Notably, Bitcoin briefly surpassed the $100.000 mark on Monday, but macroeconomic news and market pressures weighed heavily, driving the cryptocurrency back down. This highlights the ongoing sensitivity of Bitcoin to broader economic trends and investor sentiment.

Fear & Greed Index

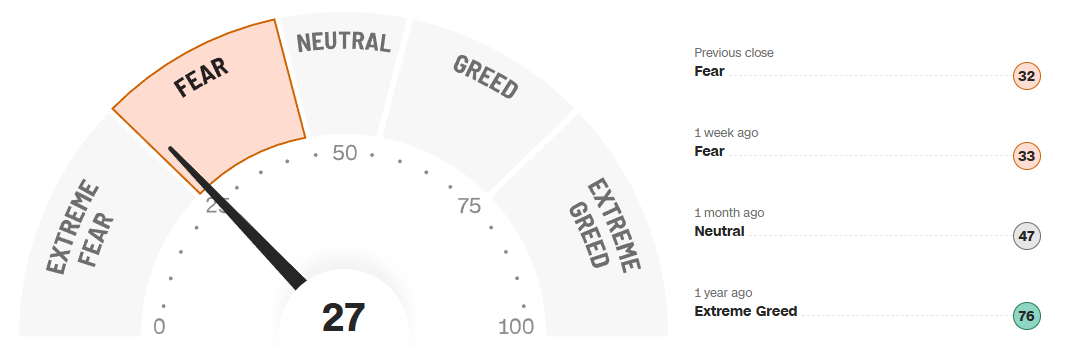

The Fear & Greed Index experienced another decline, driven by Friday's stronger-than-expected jobs report. This robust employment data has reignited concerns about potential inflationary pressures, as it suggests the economy may remain resilient enough to warrant tighter monetary policy in the near future.

CBOE Volatility Index (VIX)

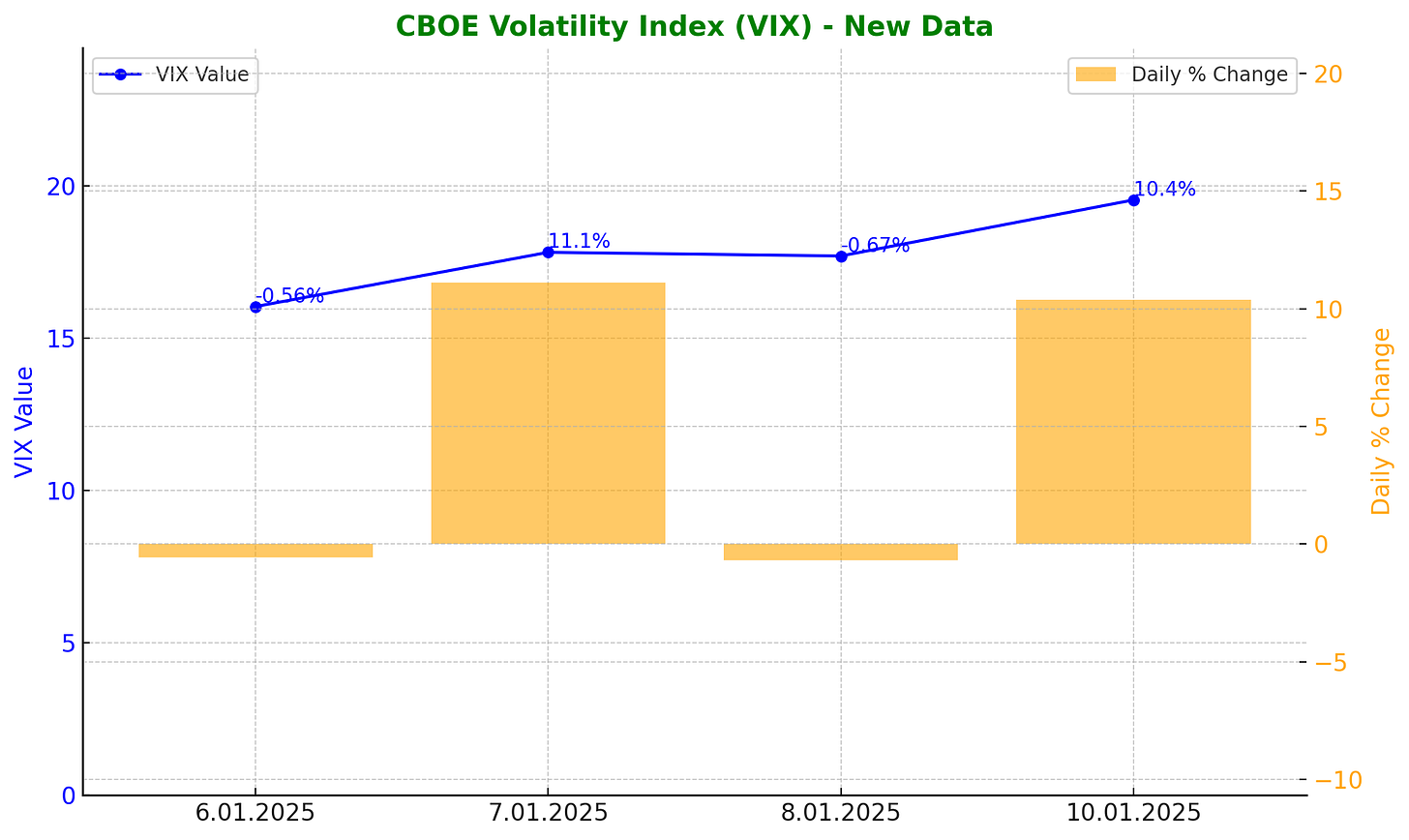

Similar to the Fear & Greed Index, the VIX experienced two notable spikes last week, both triggered by macroeconomic events, including a stronger-than-expected jobs report and remarks from Federal Reserve officials discussing the potential for higher inflation. On a weekly basis, the VIX rose by an impressive 21.14%, signaling increased market volatility and heightened investor caution.

Macro news of the week

Musk Says DOGE’s Goal to Cut $2 Trillion in Spending Is ‘Best-Case Outcome’

December jobs report: Big 256,000 gain fans inflation fears and Fed rate-cut doubts

Fewer rate cuts and higher loan costs - how US jobs surprise affects you

‘Inflation levels seem to be increasing’: Businesses are worried about tariffs and rising prices.

Trump reportedly considering important alteration to tariff plans

Fed officials are worried about the inflation impacts from Trump’s policies, minutes show

Trump could declare national economic emergency to justify universal tariffs, CNN reports

Private sector companies added 122,000 jobs in December, less than expected, ADP says

US intensifies sanctions on Russian oil: Equities tumble, crude prices rally

Tech news of the week

Foxconn Posts Record Fourth-Quarter Revenue on AI Demand

CES 2025: AI Advancing at ‘Incredible Pace,’ NVIDIA CEO Says

Meta Adds UFC’s Dana White to Board

Nvidia, chip stocks pop after Foxconn reports record revenue

Tencent shares fall 8% in Hong Kong after U.S. designates it a Chinese military company

Microsoft Plans to Invest $3 Billion on AI, Cloud Infrastructure in India

AI Startup Anthropic Raising Funds Valuing It at $60 Billion

Samsung Expects Further Profit Growth Slowdown, Missing Estimates

Amazon Plans to Invest at Least $11 Billion in Cloud and AI Infrastructure in Georgia

Nvidia, Google, OpenAI Turn To 'Synthetic Data' Factories To Train AI Models

Elon Musk calls on California and Delaware to force auction of OpenAI stake

Google is building its own ‘world modeling’ AI team for games and robot training

Google, Microsoft each donating $1M to Trump’s inaugural fund

Meta Trials eBay Listings on Facebook Marketplace Following EU Antitrust Pressure

Nvidia’s Jensen Huang is ‘dead wrong’ about quantum computers, D-Wave CEO says

Disney says about 157 million global users are streaming content with ads

Apple’s inaccurate AI news alerts shows the tech has a growing misinformation problem

The best actually real stuff at CES 2025

There’s a new contender for budget smartwatch king

TSMC Sales Beat Estimates in Boost for AI’s Outlook in 2025

Meta Ends Fact-Checking on Facebook, Instagram in Free-Speech Pitch

Elon Musk’s xAI Launches Stand-Alone Grok App

Tesla launches refreshed Model Y in China to fend off domestic rivals

Blackstone to Make $300 Million Investment in AI Data Company

Apple CEO Tim Cook’s 2024 Pay Rises 18% to $74.6 Million

TikTok’s Founder Has a Formula for Everything. Can It Crack the Supreme Court?

TikTok warns of broad consequences if Supreme Court allows ban

Supreme Court seems likely to uphold a law that could ban TikTok in the U.S. on Jan. 19

Samsung claims its Ballie AI robot will actually be released this year

Microsoft is using Bing to trick people into thinking they’re on Google

If you found this article valuable, I’d be grateful if you shared it with others who might also find it interesting. Thank you!